TMT Bar GST Rate Guide: Cut Surprises in Your Steel Bills

Ever faced last-minute billing surprises, like a GST error or an incorrect HSN entry? These issues can disrupt your cost sheet, leading to project delays and cash flow bottlenecks. In an industry where timely procurement is critical, even a minor discrepancy can have a ripple effect, halting progress at the site.

With steel demand in India growing rapidly, domestic consumption is set to increase by 9–10% in 2025. The pressure on teams to manage sourcing efficiently is only mounting. Projects must stay on track with clean invoicing, predictable pricing, and risk-free paperwork to avoid disruptions.

In this blog, we’ll break down everything you need to know: understanding the TMT bar GST rate, key HSN codes, ITC rules, freight considerations, and how these elements impact your costs. By the end, you'll have a clear checklist to ensure accurate sourcing, smooth invoicing, and uninterrupted project progress.

Key Takeaways:

-

TMT bars carry 18% GST under HSN 7214, making correct coding essential for clean billing.

-

Mixed steel items need careful HSN checks to prevent ITC issues during monthly filing.

-

Freight GST and interstate movement can change the landed cost for project orders.

-

Strong ITC records help avoid reversals and protect your working capital.

-

SteelonCall supports buyers with genuine branded steel, transparent pricing, and on-time deliveries.

GST Basics Every Steel Buyer Should Know

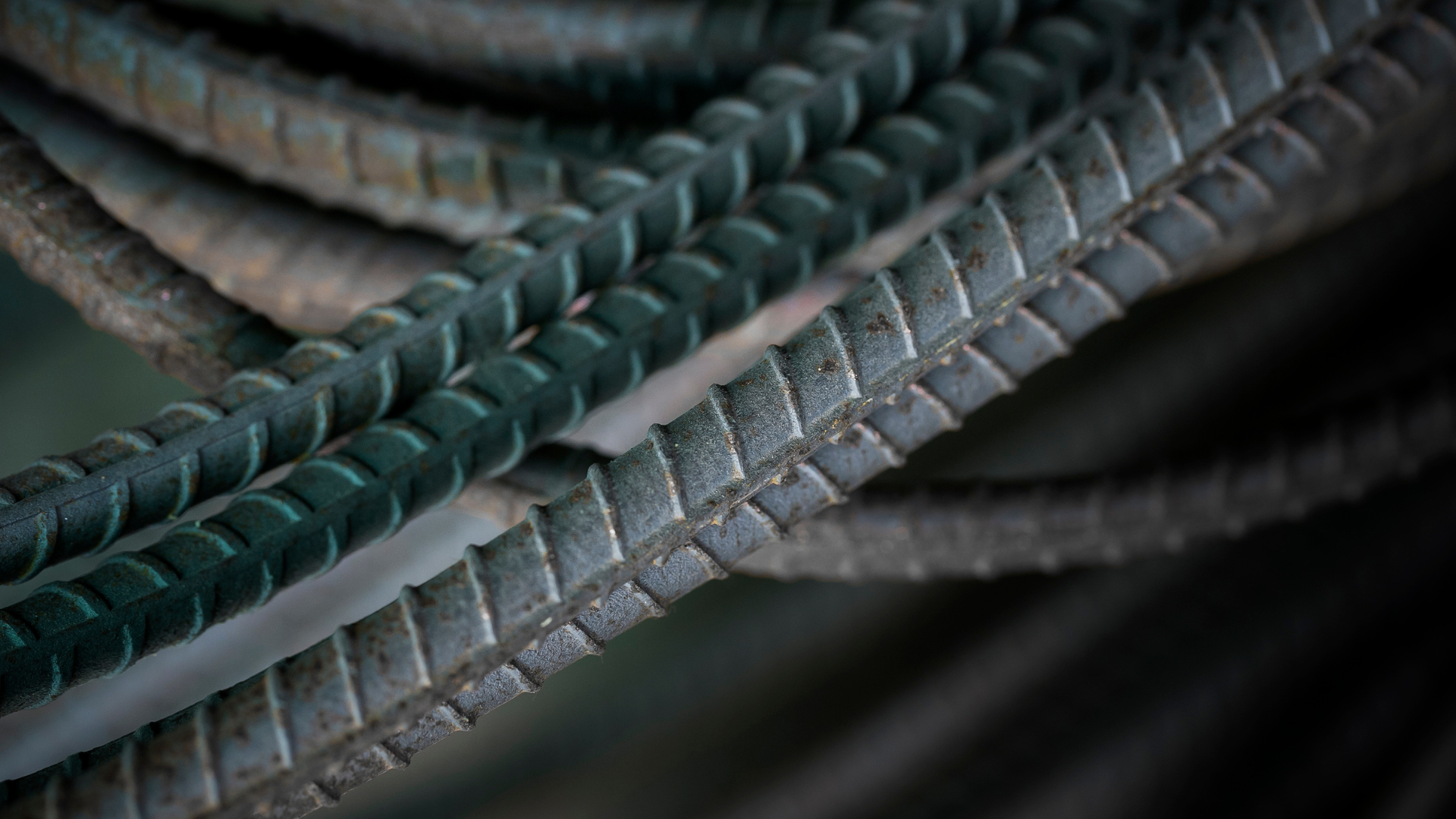

GST on steel stays simple on paper. Most steel products, including TMT bars under HSN 7214, fall under an 18% slab. This covers rods, bars, structural items, pipes, and scrap that many construction and fabrication teams buy every week.

Steel sourcing spans multiple cycles, making accurate tax treatment essential for smooth coordination among procurement teams, vendors, and finance departments. Many issues arise when invoices carry incorrect HSN entries, unclear freight details, or missing fields that block credit flow for several weeks.

Why you must pay attention:

-

ITC approval depends on correct HSN codes and complete invoices that match every order raised by your procurement team.

-

Tender values can fail when GST information remains unclear, leading to confusion during bid evaluation or contract signing.

-

Freight GST can change the delivered price per truckload, especially for teams sourcing steel across multiple states.

-

E-way bills and shortage records can create issues during checks, affecting delivery timelines and overall site progress.

If you want clear GST-included prices without last-minute additions, you can source your steel through SteelonCall and keep your purchase planning steady.

With the basic structure covered, you can now look at the actual GST slabs that appear frequently on vendor invoices.

Also Read: TMT Bars and their Applications in Construction

Current GST Rate Summary and Why You See Conflicting Information

Many procurement teams continue to receive invoices showing an 18% GST rate for TMT bars under HSN 7214 across most construction projects. Some updated lists mention lower slabs for certain steel groups, which creates confusion for buyers handling mixed categories during large orders.

Your safest approach is to match each item with the correct six-digit or eight-digit HSN code before accepting the tax rate shared by the vendor.The table below provides a quick overview of the GST rates commonly applied to core steel items, helping you verify the correct slab during routine procurement checks.

Standard GST Rates Applied on TMT Bars and Related Steel Items:

|

HSN Code |

Product Category |

GST Rate Commonly Seen |

Buyer Notes |

|

7214 |

TMT bars, steel rods, deformed bars |

18% |

Vendors widely follow this rate; confirm the eight-digit sub-code for accuracy. |

|

7204 |

Steel scrap |

18% |

Must match 7204 on invoices to avoid ITC disputes involving scrap. |

|

7304 |

Seamless steel pipes |

18% |

Used for pressure lines or for fabrication jobs that require seamless tubes. |

|

7306 |

Welded pipes and hollow sections |

18% |

Often mistaken for seamless pipes; verify code before approving invoices. |

|

7216 |

Angles, channels, structural shapes |

18% |

Used across beams, bracings, and structural fabrication work. |

Note:

-

Use the full 8-digit HSN (e.g., 7214 20 90) on invoices to avoid ITC mismatch.

-

Note: Values are based on the latest notified slabs and remain subject to updates issued by the GST Council.

If your orders include multiple steel groups, you may need a deeper view of GST slabs applied across a broader product range.

Extended GST Reference Table for Steel Grades and Related Products

Some projects involve multiple steel groups, and teams need clarity before clearing invoices or planning bulk orders. It's critical to verify that each category has the correct HSN code and GST rate. This is especially important for large orders with multiple categories, where accurate categorization ensures proper tax application.

Accurate categorization ensures transparent billing and reduces confusion during audits or return checks. Mixing steel items like scrap, structural steel, and stainless steel in one invoice can lead to incorrect GST application, causing delays in ITC claims and creating administrative issues.

Cross-referencing HSN codes and their GST rates helps avoid discrepancies and supports better planning. This is key for large orders with multiple categories, as variations in tax rates across steel types can impact overall costs and cash flow.

Here’s a breakdown of the GST slabs applied to various steel categories:

|

HSN Code |

Steel Category |

CGST |

SGST / UTGST |

IGST |

|

7204 |

Ferrous waste, scrap, remelting scrap ingots |

9% |

9% |

18% |

|

7205 |

Granules and powders of pig iron or steel |

9% |

9% |

18% |

|

7206 |

Non-alloy steel in ingots or primary forms |

9% |

9% |

18% |

|

7207 |

Semi-finished iron and non-alloy steel products |

9% |

9% |

18% |

|

7208–7212 |

Flat-rolled non-alloy steel sheets and plates |

9% |

9% |

18% |

|

7213–7215 |

Bars and rods of non-alloy steel |

9% |

9% |

18% |

|

7216 |

Angles, channels, and structural shapes |

9% |

9% |

18% |

|

7217 |

Wire of iron or non-alloy steel |

9% |

9% |

18% |

|

7218 |

Stainless steel in ingots or primary forms |

9% |

9% |

18% |

|

7219–7220 |

Flat-rolled stainless steel products |

9% |

9% |

18% |

|

7221–7222 |

Stainless steel bars and rods |

9% |

9% |

18% |

|

7223 |

Stainless steel wire |

9% |

9% |

18% |

|

7224 |

Alloy steel ingots or primary forms |

9% |

9% |

18% |

|

7225–7226 |

Flat-rolled alloy steel products |

9% |

9% |

18% |

|

7227–7228 |

Alloy steel bars and rods |

9% |

9% |

18% |

|

7229 |

Alloy steel wire |

9% |

9% |

18% |

|

7301 |

Steel sheet piling and welded structural sections |

9% |

9% |

18% |

|

7304 |

Seamless steel pipes and hollow profiles |

9% |

9% |

18% |

|

7305 |

Large welded steel pipes above 406.4 mm in diameter |

9% |

9% |

18% |

|

7306 |

Welded steel pipes and hollow sections |

9% |

9% |

18% |

|

7307 |

Steel pipe fittings, including elbows and couplings |

9% |

9% |

18% |

Note: Values are based on the latest notified slabs and remain subject to updates issued by the GST Council.

By understanding GST treatment for each steel category, you can ensure smooth invoicing for mixed orders. This avoids delays in ITC claims and supports efficient procurement planning, especially for large orders with multiple categories, where tax variations across steel types can impact costs and cash flow.

Now that the basic rate picture is clear, the next step is to understand how GST behaves when steel moves within a state versus across state borders.

Also Read: Overview of Steel Prices

GST Difference Between Interstate vs. Intrastate Purchases

Steel moves across states frequently during project cycles, and the place of supply rules determine whether IGST or CGST plus SGST applies. Document supplier location, delivery address, contract terms, and the GRN to support each POS determination for audit defence.

Accurate POS selection prevents misclassification and protects your ITC during monthly filings and departmental reviews. Below is a table summarising GST treatment for common steel purchase scenarios and the buyer actions required:

|

Purchase Type |

GST Applied |

Billing Method |

Impact on Buyer |

|

Intrastate supply |

CGST + SGST at the applicable HSN rate |

Supplier charges split tax when the supplier location and the POS are in the same state. |

Buyer claims both credits after HSN-rate validation and POS confirmation; retain POS evidence. |

|

Interstate supply |

IGST at the applicable HSN rate |

Supplier charges IGST when the supplier location and the POS are in different states |

Buyer claims IGST as a single entry after confirming the POS under the IGST Act and documenting the basis. |

|

Freight under RCM (GTA not opted for forward charge) |

5% under RCM |

GTA issues an invoice without GST; liability shifts to the recipient |

Recipient pays 5% only if within eligible categories; ITC available subject to Section 16 and proper RCM compliance. |

|

Freight under forward charge (GTA opted) |

12% under forward charge |

GTA charges GST directly after filing an annual option declaration before the financial year |

The buyer may claim ITC when the GTA’s declaration is on record, and the invoice/consignment details align with the forward charge. |

|

Freight by a non-GTA road transporter |

Exempt (no GST) |

No consignment note; simple freight bill without GST |

No ITC; exemption applies only when no consignment note is issued, confirming non-GTA classification. |

Note:

-

If no consignment note is issued, the transporter is not considered a GTA and the service is exempt from GST.

-

Values are based on the latest notified slabs and remain subject to updates issued by the GST Council.

Follow these checks and documentation steps to reduce departmental queries, protect ITC, and keep procurement files audit-ready for all steel purchases.

Once the tax treatment based on supply location is understood, you can see how these rules add up on your final landed cost and influence real project budgets.

Also Read: Where can I buy TMT bars online in India

How GST Changes Your Steel Procurement Cost

GST influences your landed cost on every steel purchase, especially when vendors follow different billing structures across mixed steel categories within the same order. These variations affect cash planning, ITC timing, freight budgeting, and payment schedules across active construction or fabrication projects.

Many teams face issues when invoices carry unclear entries, which slow internal checks and create confusion during month-end reconciliation. Clear tax treatment helps you maintain predictable costs and avoid delays during routine sourcing cycles.

The points below explain how GST affects your overall procurement costs and support better planning for both regular and bulk orders.

Key Cost Factors Affected by GST

-

Freight charges may be subject to different GST treatments, which can change the landed price per truckload during periods of heavy material movement.

-

Incorrect HSN entries or E-way bill mismatches can block ITC and delay refunds, affecting working capital during long cycles of steady steel consumption.

-

Variations in rates across steel categories may confuse you, especially when vendors mix scrap, pipes, and structural items on a single consolidated invoice.

For example, a contractor in Visakhapatnam ordering FE500D 8mm TMT bars through SteelonCall at ₹50,000 per ton receives genuine branded steel supported by transparent billing. The GST adds ₹9,000, bringing the subtotal to ₹59,000, before handling charges are applied on the final invoice.

When handling charges of ₹383.5 are added, the landed cost becomes ₹59,383.5 for one ton with delivery arranged to arrive on time. This supports fair and transparent pricing and helps you maintain accurate cost sheets during continuous project requirements.

Many contractors prefer SteelonCall for this reason, since the pricing breakdown remains clear and deliveries are planned to arrive on time.

To fully understand, you now need a clear checklist to help you claim ITC without gaps during audits or monthly reviews.

Input Tax Credit Rules Compliance Checklist

ITC plays a significant role in your monthly cash flow, especially when large steel orders move through multiple vendors during active project cycles. Clean documentation helps your team avoid credit reversals, audit issues, and unwanted delays that may affect project planning or material scheduling.

The checklist below gives you clear steps to protect your ITC claims on TMT bars and other steel items across different purchase stages.

-

Verify that vendors have filed returns and remitted the collected tax to keep your ITC valid.

-

Ensure each invoice carries the correct GSTIN, HSN codes, product descriptions, and tax breakup.

-

Confirm that the steel purchased supports taxable business activity at active project sites.

-

Exclude purchases for personal or non-business use since they do not qualify for ITC.

-

Reconcile invoices with vendor filings to prevent mismatches during returns.

-

Claim eligible ITC before the statutory deadline for the relevant financial year.

-

Maintain organized records such as invoices, delivery challans, e-way bills, material logs, and contract references for inspections.

-

Check e-invoicing requirements and ensure invoices have valid IRNs.

-

Review restricted categories to ensure your steel items do not fall under ineligible groups.

-

Keep internal approvals linking steel purchases to taxable work for clear audit visibility.

-

Support shortage adjustments with proper credit notes to avoid return mismatches.

-

Conduct periodic internal reviews to detect gaps early.

-

Prepare a short POS memo summarising supplier location, billing details, and supporting documents.

-

Collect transporter records, including consignment notes or classification declarations.

-

Validate HSN codes and applicable rates with approved GST lists or vendor documentation.

-

For RCM freight cases, raise a self-invoice, record the payment, update the returns, and store the reconciliation proof.

-

Perform monthly GSTR-2B reconciliation, log exceptions, communicate with vendors, and resolve mismatches.

-

Match invoice GSTIN, place-of-supply details, and descriptions with e-way bill entries before accepting deliveries.

-

Retain PO, GRN, invoices, e-way bills, payment proofs, and vendor return extracts as an audit pack.

-

Work with vendors that follow correct coding and clean billing to reduce verification issues.

Working with vendors that maintain accurate HSN codes and clean billing practices, such as SteelonCall, helps reduce mismatches during audits.

Why Many Contractors Prefer SteelonCall for Steel Sourcing

Contractors and project teams need price clarity, dependable movement, and trusted sellers to keep site activity steady. SteelonCall supports this through a digital steel marketplace that brings pricing, supplier credibility, and delivery planning into one coordinated buying experience.

Here are key reasons buyers choose SteelonCall for recurring steel requirements:

-

Verified vendors: Each supply partner follows steady material standards, helping you avoid mixed lots or unexpected grade shifts during delivery.

-

GST-included pricing online: You can see the full price before booking, which helps maintain clean cost sheets across active project cycles.

-

Access to branded steel: Teams can request known mills like Vizag Steel when project requirements call for clear sourcing records.

-

Bulk order support: Larger orders receive planned movement, weight guidance, and timing built around site availability and handling needs.

-

Technical and customer guidance: Support teams help with grade choices, weight checks, HSN confirmation, and document clarity during planning.

-

Delivery tracking: You can check movement updates and prepare unloading teams based on expected weight and quantity.

These steps help you plan each order with more clarity and reduce delays linked to unclear supply details. This brings better predictability to ongoing projects across construction and fabrication sites.

Conclusion

Clear GST understanding helps you plan steel purchases with confidence and avoid billing surprises that may affect your project schedule or cash position. When tax treatment, HSN codes, and ITC rules stay accurate, your team gains better control over site demand, vendor coordination, and monthly budgets.

If you want support with sourcing, grade selection, or steady supply planning, the advisors at SteelonCall provide practical guidance to contractors and businesses daily. SteelonCall is the only platform that gives you actual steel prices online, allowing you to enter your requirement and see the price instantly before placing an order.

Browse our full range of MS and SS steel atwww.steeloncall.com, and move your project forward with a steady supply and trusted vendor support.

FAQs

1. Do GST rate changes affect old contracts already signed with suppliers?

Yes. If the GST Council revises the rates, contracts with variation clauses must be adjusted accordingly. Suppliers issue revised invoices for the affected period, and buyers should record each change to avoid audit disputes.

2. Can GST on returned or rejected steel be claimed back easily?

Yes, provided the supplier issues a valid credit note linked to the original invoice. ITC reversal and re‑claim must be reconciled in GSTR‑2B. Buyers should document weight differences and acceptance notes to complete the process.

3. Does job-work billing for cutting and bending affect GST treatment?

Cutting and bending are treated as services, so job-work invoices carry separate GST on the service value. The steel sent for processing moves on a delivery challan without extra tax. Buyers should track return quantities and scrap movement for clean records.

4. How does GST apply when steel is stored at a third-party warehouse?

GST depends on the original supply movement, not the storage address the buyer later uses. Warehousing charges carry separate GST, which can be claimed if linked with business activity. Buyers should maintain stock records to support audit checks on movement and usage.

5. Are advances paid to steel vendors covered under GST?

For steel purchases, GST is not charged at the time of receiving an advance because tax applies only when the invoice is raised or the supply takes place. The buyer can claim ITC once the vendor issues the tax invoice and links it with the order and payment records, keeping documentation clear for monthly filings.